WASHINGTON — As some taxpayers begin to prepare their paper tax returns, the Internal Revenue Service notes that some may be sending their returns to a different service center than last year. Those who received a tax instruction booklet from the IRS in the mail and use the labels included with the booklet can be assured that their tax returns will go to the correct address. Taxpayers who e-file are not affected by these changes.

For tax year 2007, the mailing changes affect returns, with or without payments, from seven states: Iowa, Kansas, Kentucky, Oklahoma, Pennsylvania, West Virginia, and Wisconsin.

Taxpayers should send:

Returns from Iowa, Kansas, Oklahoma and Wisconsin to the IRS center in Fresno, California.

Returns from Kentucky to the IRS center in Austin, Texas.

Returns from Pennsylvania and West Virginia to the IRS center in Kansas City, Missouri.

For taxpayers who file paper returns, the correct center addresses are on labels inside the tax packages they receive in the mail. Taxpayers who do not receive a package should refer to the back cover of the instructions to Form 1040, 1040A or 1040EZ.

Taxpayers who e-file will not be affected by these changes. Last year, 57 percent of all individual income tax filers chose to e-file their tax returns.

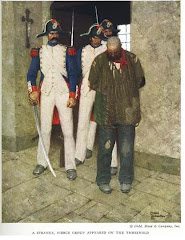

Cover Les Miserables

By: Mead Schaeffer

Tal"s red Turtleneck

"I love taxes as much as I love my red turtleneck"

My Friend Theresa

Her 7th grade picture

Other tax related sites

- IRS NEWS

- Tax Facts

- Irs Tax Relief

- Shiela's Blog

- Baby Boomer's Taxes

- Tax Resolutionaries

- Sharon's Blog

- Sara's Blog

- Taxadelic

- Melissa's Blog

- Leslie's Blog

- Tax Help

- Accounting Problems Blog

- Elizabeth's Blog

- IRS Help 4 You

- Tax Consultant Blogs

- Brain's Blog

- Ashley's Tax Blog

- IRS Minds

- Tax Consultant 4 You

- Strange Land

Blog Archive

-

▼

2008

(43)

-

▼

February

(9)

- 2008 Economic Stimulus Act Provides Tax Benefits t...

- IRS Will Send Stimulus Payments Automatically Star...

- IRS Offers New Online Help Tools for 2008 Tax Filers

- Tax Returns from Seven States Go to Different Centers

- IRS Announces Energy Bond Allocations

- Mortgage Workouts, Now Tax-Free for Many Homeowner...

- Tax Returns from Seven States Go to Different Cent...

- Wow now this is crazy!

- Original Survivor doesn't survive the US District ...

-

▼

February

(9)